Our Advisory Process

At The Gorton Wealth Management Group, we believe that your wealth plan is the foundation from where all other investment decisions are made.

Understand

We are committed to spending time with you, listening and then preparing a detailed financial framework that outlines current strategies, and analyzing various options to construct an investment strategy that takes you from where you are in life to where you want to be.

Plan

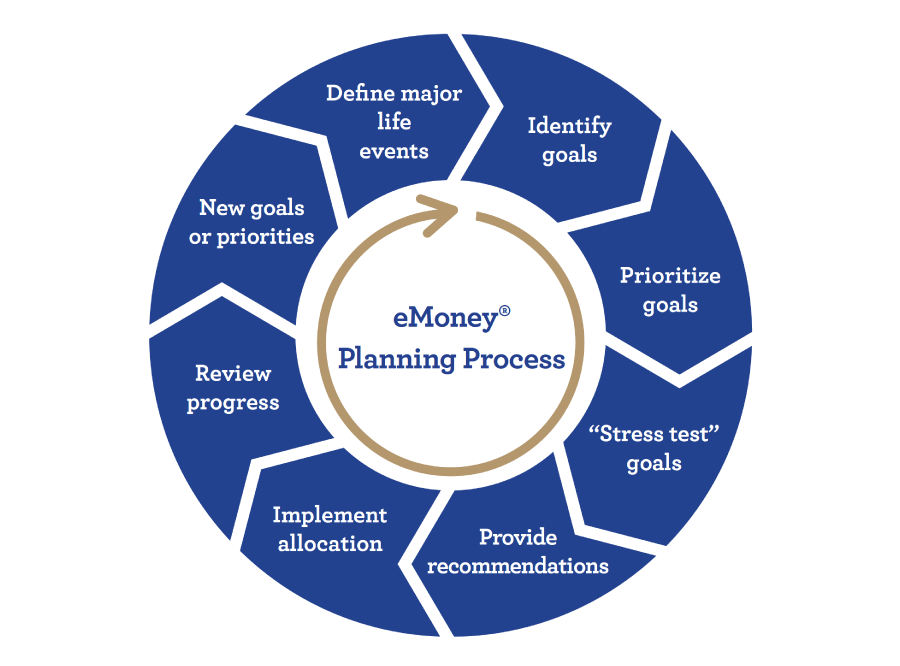

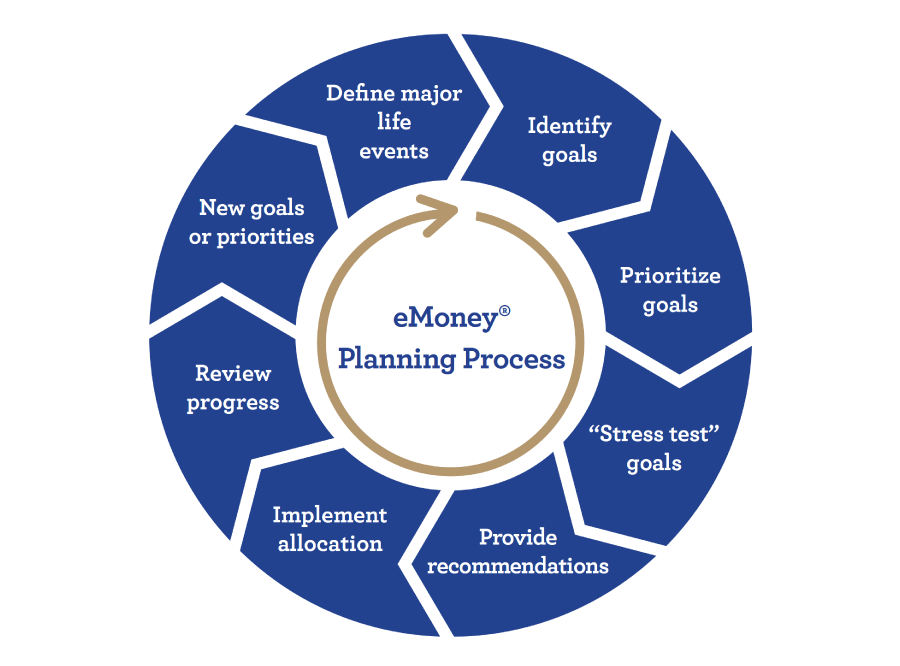

LifeSync/eMoney: The Planning process is the engine of our client’s financial success. Once we have gotten a detailed look at your circumstances, and created a shared vision of where you want to be, we can then begin to “stress test” your investment goals using eMoney. Our analysis will take a thousand different historical market scenarios and stress test your set of goals to determine our chances of success.

Propose

Based on your priorities and preferences, we can adjust certain aspects of your plan to help ensure your success. You can be assured that the proposed strategies reflect your financial objectives and desires, and that they are coordinated with your stage in life as well as the dynamics of the current marketplace.

Implement

We will deploy assets into your mutually agreed upon allocation that takes into account your needs as well as current market and economic conditions.

Review Progress

In addition to monthly statements, PIM clients will receive quarterly performance reports for PIM that update your progress. Additionally, we will review your plan to ensure that we are staying on track to meet your goals.

Revisit

Review Meetings: So, what has changed? While we always want to be available to our clients to answer questions or discuss their portfolios, we feel it is important that we get together to review their financial advisory plan at least annually, and in some cases more frequently than that.

IMPORTANT: The projections or other information generated by eMoney regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results and are not guarantees of future results. Results may vary with each use and over time. Based on accepted statistical methods, eMoney uses a mathematical process used to implement complex statistical methods that chart the probability of certain financial outcomes at certain times in the future. This charting is accomplished by generating hundreds of possible economic scenarios that could affect the performance of your investments. Using Monte Carlo simulation this report uses up to 1000 scenarios to determine the probability of outcomes resulting from the asset allocation choices and underlying assumptions regarding rates of return and volatility of certain asset classes. Some of these scenarios will assume very favorable financial market returns, consistent with some of the best periods in investing history for investors. Some scenarios will conform to the worst periods in investing history. Most scenarios will fall somewhere in between.

The PIM program is not designed for excessively traded or inactive accounts and is not appropriate for all investors. Please carefully review the Wells Fargo Advisors advisory disclosure document for a full description of our services. The minimum account size for this program is $50,000.

“And in the end, it's not the years in your life that count. It's the life in your years."

- Abraham Lincoln